Getting The Nj Cash Buyers To Work

Getting The Nj Cash Buyers To Work

Blog Article

More About Nj Cash Buyers

Table of Contents5 Easy Facts About Nj Cash Buyers ShownThe 7-Second Trick For Nj Cash BuyersAbout Nj Cash BuyersTop Guidelines Of Nj Cash Buyers

A lot of states give customers a specific degree of protection from financial institutions regarding their home. "That suggests, regardless of the worth of the house, financial institutions can not compel its sale to please their claims," states Semrad.If your home, for example, is worth $500,000 and the home's mortgage is $400,000, your homestead exception can prevent the forced sale of your home in order to pay creditors the $100,000 of equity in your home, as long as your state's homestead exemption is at least $100,000. If your state's exception is much less than $100,000, a personal bankruptcy trustee can still compel the sale of your home to pay creditors with the home's equity in extra of the exception. If you fall short to pay your property, state, or federal tax obligations, you might lose your home through a tax obligation lien. Getting a residence is a lot simpler with cash.

(https://writexo.com/share/tjn2ae7b)I recognize that many sellers are more most likely to approve a deal of cash, but the vendor will get the money no matter of whether it is funded or all-cash.

The Definitive Guide for Nj Cash Buyers

Today, regarding 30% of US homebuyers pay cash money for their buildings. That's still in the minority. There may be some great reasons not to pay cash money. If you simply have sufficient money to spend for a residence, you may not have actually any left over for repair work or emergency situations. If you have the cash, it may be a good idea to establish it apart to make sure that you have at least 3 months of real estate and living expenses must something unforeseen take place was shedding a job or having clinical concerns.

You may have qualifications for an excellent home mortgage. According to a current research by Cash magazine, Generation X and millennials are taken into consideration to be populaces with one of the most prospective for development as customers. Tackling a little bit of financial debt, particularly for tax obligation functions fantastic terms may be a better choice for your financial resources overall.

Maybe spending in the supply market, common funds or an individual business may be a much better option for you in the lengthy run. By acquiring a residential or commercial property with cash, you risk diminishing your get funds, leaving you prone to unexpected maintenance expenses. Owning a residential property requires ongoing expenses, and without a mortgage pillow, unexpected fixings or renovations could stress your financial resources and impede your capability to maintain the property's condition.

What Does Nj Cash Buyers Mean?

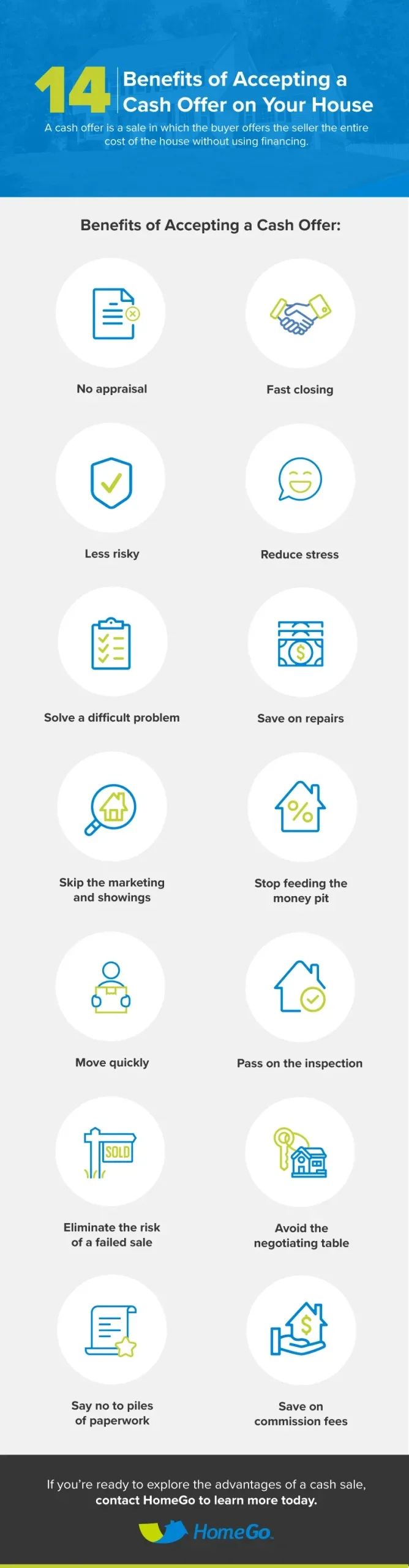

Home costs fluctuate with the economic situation so unless you're intending on hanging onto the home for 10 to 30 years, you may be far better off spending that money somewhere else. Buying a home with cash money can accelerate the buying process considerably. Without the demand for a home mortgage approval and associated documentation, the transaction can close quicker, giving an one-upmanship in affordable property markets where vendors may choose cash buyers.

This can cause considerable cost savings over the long-term, as you will not be paying interest on the financing amount. Cash money customers commonly have stronger settlement power when managing vendors. A money deal is extra eye-catching to sellers since it decreases the threat of a bargain failing as a result of mortgage-related issues.

Keep in mind, there is no one-size-fits-all solution; it's important to tailor your decision based upon your specific situations and lasting ambitions. Ready to get going taking a look at homes? Provide me a call anytime.

Whether you're liquidating possessions for a financial investment building or are vigilantly saving to buy your desire home, getting a home in all money can dramatically increase your purchasing power. It's a strategic relocation that reinforces your position as a customer and improves your flexibility in the real estate market. Nevertheless, it can put you in an economically at risk spot (cash for homes nj).

The Ultimate Guide To Nj Cash Buyers

Minimizing passion is among one of the most common factors to purchase a home in money. Throughout a 30-year home mortgage, you might pay tens of thousands or also hundreds of hundreds of dollars in total passion. Furthermore, your purchasing power boosts without funding contingencies, you can discover a more comprehensive choice of homes.

Realty is one financial investment that has a tendency to exceed inflation gradually. Unlike stocks and bonds, it's thought about much less risky and can supply short- and lasting wide range gain. One caution to note is that during particular financial markets, realty can produce less ROI than various other financial investment types in the short term.

The most significant risk of paying money for a residence is that it can make your finances unpredictable. Binding your liquid assets in a property can lower economic versatility and make it a lot more challenging to cover unforeseen expenditures. In addition, binding your money means losing out on high-earning investment possibilities that might yield greater returns elsewhere.

Report this page